Why we say no to investors and are 100% user-supported?

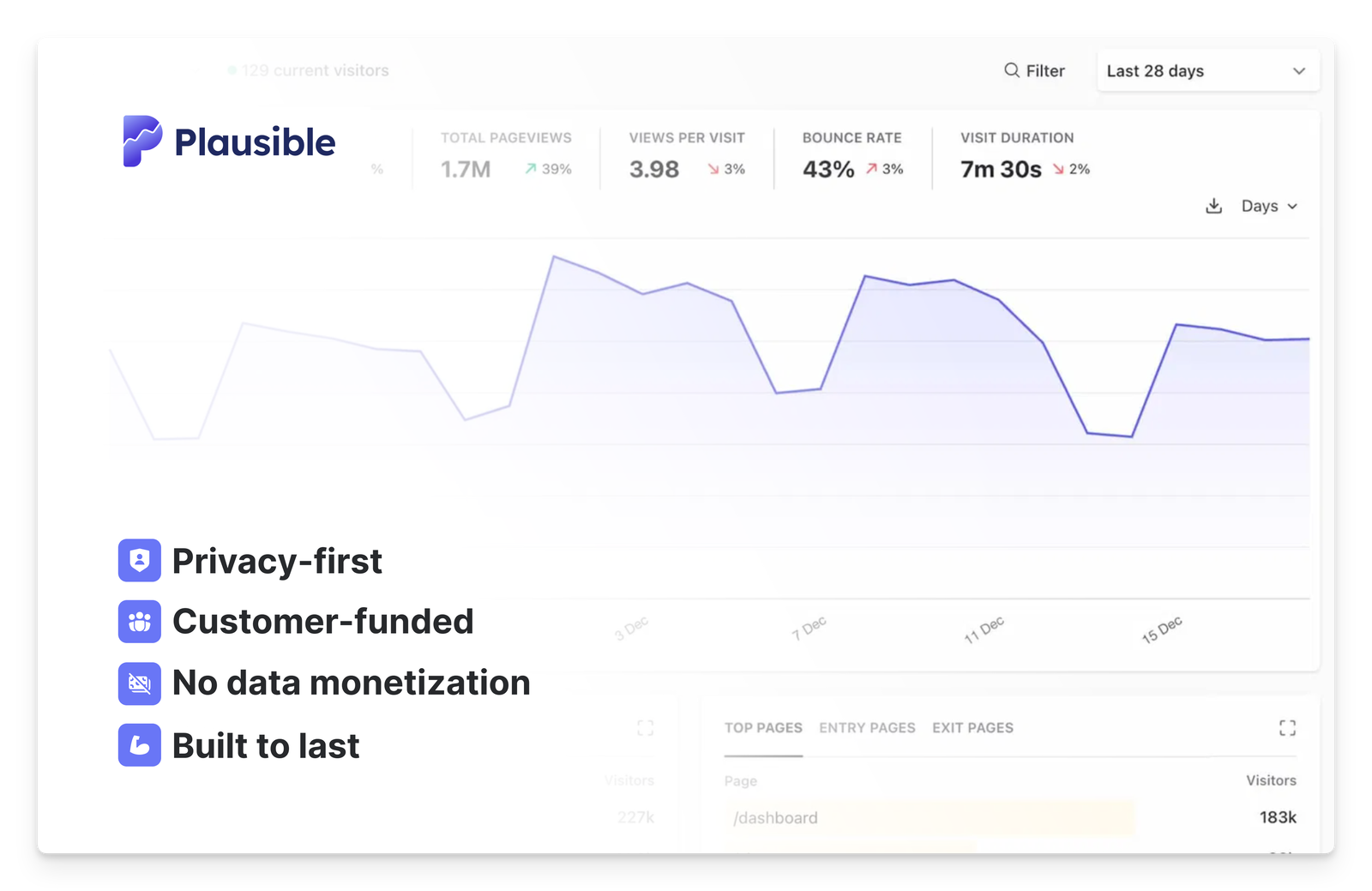

Plausible has been several years into business. We’re sustainably profitable and solely funded by our subscribers. We have never raised a single dollar from any investor and respectfully, don’t plan on doing so.

Why? In a nutshell: saying no to investors buys us freedom. Freedom to:

- Stay loyal to our purpose and principles, not a board of directors

- Our subscribers are happy to support us

- Our structure allows for it

- Why don’t we sell data?

- We like to stay “small”

- Other things we deliberately say no to

- Lastly, we love ourselves

- What do we give up by doing this?

Stay loyal to our purpose and principles, not a board of directors

Our simple purpose is to give you simple and privacy-first analytics to help you measure your website performance and that ends there.

If there were investors, we would have two groups to satisfy: customers and shareholders. Those goals often diverge. But without investors, every decision can stay loyal to our purpose. That translates to:

- Shipping fewer but higher quality features

- Saying no to markets that dilute focus

- Growing only as fast as revenue allows

Investors usually need outsized returns. Our priority is privacy and simplicity, which would be harder to protect under growth-at-all-costs incentives.

Our subscribers are happy to support us

And thank you for that! We adhere to the old school give-money-get-product-in return model (well in our case it’s the subscription).

This is the only way we can keep Plausible running, because our incentives are aligned with our users. This essentially makes us (the team and the subscribers) the true stakeholders of Plausible and not an outside party whose incentives are simply not the same as ours.

So far as financial success is concerned: The simple math is that if a company makes a few million in annual profit and has low costs, the team behind it is financially secure. So we do not need an exit to be successful by today’s definitions.

With investors, success is often defined as acquisition or IPO. We don’t want to do that. Real success for us is sustainable financial freedom and not a glorified exit.

“Ok, but how does this actually work?”

Our structure allows for it

The truth is that venture backed startups are great for problems that require massive upfront capital or winner takes most dynamics.

But for a focused SaaS product like ours with clear customers and steady demand, saying no to investors makes more sense for us.

Some people argue that investors might have helped us offer Plausible for free like our main competitor out there (although they aren’t truly free either), but that would force us to make money some other way. And that easiest “other way” for an analytics tool is to sell customer data which is exactly what plausible was built to fight against.

Why don’t we sell data?

Plausible is not just “analytics software.” It is an explicit alternative to surveillance driven analytics. We don’t plan to abandon that purpose – ever.

Privacy for us is a non-negotiable promise we make to our users. We mean it when we say that your data is not being resold and there is no hidden secondary business model. This trust has compounded over time.

Secondly, data selling would rot the product which we are categorically against as explained above. It would force us to collect more data than needed, add tracking under vague consent language, and obscure what is actually collected.

If we had investors, data monetization would constantly be “on the table” and the growth targets would pressure expansion of tracking. Financial independence removes that pressure.

We like to stay “small”

We have an intentionally small team, which again cuts costs and the need to raise money. Although that is not the reason we stay small. Neither are we anti-growth. We’re just very careful with adding complexity to our processes in the name of scaling the team.

One person adds work. Two people add coordination. Ten people add communication systems. Thirty people add management layers, meetings, process, conflict resolution, hiring pipelines, performance reviews, and politics.

Staying small allows us to avoid a situation where the company must keep growing just to justify its own structure. Sounds like a self-inflicted paradox.

Also, Plausible grew because it’s opinionated and consistent. A small team allows us to decide quickly, hold context in our heads, fix things without handoffs and trust each other without process.

Other things we deliberately say no to

We say no to performative credibility.

It was fine when startup founders actually needed some capital to get started. Now the trend is to get into the funding process just to network or make fancy “we raised so and so millions” announcements to get some short-term credibility. We like to instead focus on slowly building a tribe instead of surface-level credibility.

We say no to short-term wins that weaken long-term trust.

Not having investors allows us to choose transparent pricing instead of growth hacks, sustainable subscription revenue instead of aggressive funnels and long term trust over short term metrics.

Lastly, we love ourselves

In a true self-love fashion, we love to spoil ourselves with the following benefits of not having a “rich dad” over our heads. This means that we get to have:

- Less anxiety about growth charts

- Fewer performative decisions

- More pride in the business itself

- A sense that the company serves our life, not the other way around

- Calm work culture and happy humans (4 day work weeks, no meetings, etc., FTW)

Taking investment is not just money, it is a commitment. Once you take it, you usually cannot slow down, pivot gently, or stay small. Bootstrapping keeps our options open: sell later or never, stay niche, step back without collapsing the company.

What do we give up by doing this?

To be fair, we do see:

- Slower growth than VC backed competitors (sometimes)

- Fewer integrations

- No “free forever” plan

- Less mindshare in hype cycles (like AI wave, trends, buzzword chasing, etc.)

We gladly accept these tradeoffs because they preserve trust, focus, long-term viability and freedom.